No federal income tax withheld on paycheck 2020

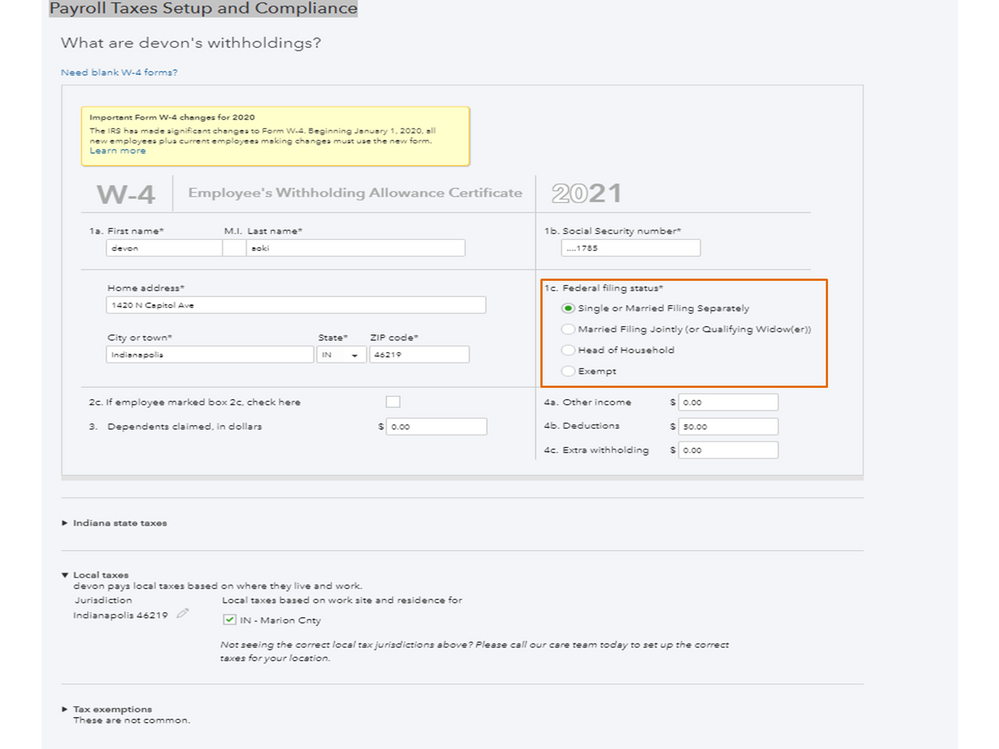

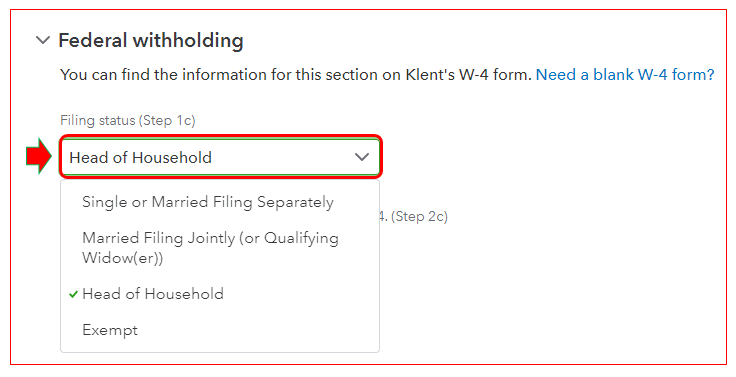

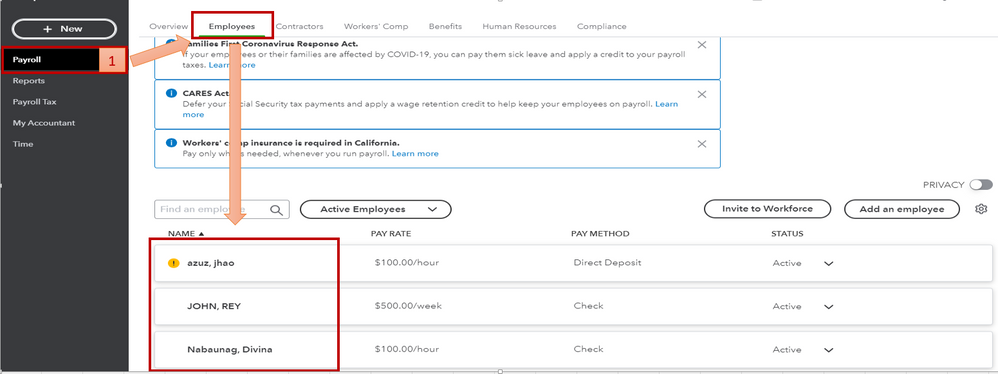

To determine the correct federal tax withheld from your pay you will need to complete your W-4. Theres no escaping federal income tax.

Federal Tax Deduction Is Not Coming Out Of Check

Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

. Washington Paycheck Quick Facts. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employees share of Social Security taxes of certain employees. Paycheck Protection Program Flexibility Act of 2020.

States dont impose their own income tax for tax year 2022. Do I have to Report Small Winnings andor Scratch Cards. Median household income in 2020 was 67340.

But you can generally deduct half of the FICA tax on your federal income tax return. A refundable credit against federal income tax equal to the qualified family leave equivalent amount with respect to the eligible self-employed individual for up to. All you have to do is submit a new Form W-4 to your employer to adjust your federal income tax withholding.

Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. There is a line on the W-4 that allows you to specify how much you want withheld. No as employee you do not have to earn a minimum income for federal and state income tax to be withheld.

Uncodified affecting IRC sections 61 and 265. If you had no federal tax withheld from your paycheck and need help navigating your taxes get help from HR Block. Even if you do not receive Form W-2G the income needs to be reported on your tax return.

Your employer withholds from your paycheck based on the information you fill in on your Form W-4. Any amount of winnings subject to federal income tax withholding. Since early 2020.

Amendments to Paycheck Protection Program Loan Forgiveness. IRS Publication 15 Circular E has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal. Most tax filers get.

If youd rather have a bigger paycheck and a smaller refund you can control this. Additional Medicare Tax Withholding Rate. Federal Paycheck Quick Facts.

Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check. If tax is withheld from your gambling winnings you will be sent a W2-G form from the payer. Treat 2019 or earlier Forms W-4 as if they were 2020 or later Forms W-4 for purposes of figuring federal income tax withholding.

Note that allowances wont be used to calculate paycheck withholding on Form W-4 starting in 2020. Federal income tax rates range from 10 up to a top marginal rate of 37. You claimed exempt on your W-4.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. Generally any income from gambling. In other words you gave Uncle Sam an interest-free loan.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. Together the Smiths. The Smith family is our second example of a household that pays zero federal income tax.

To claim exempt you must. Your contributions to a tax-deferred retirement plan like a 401k plan should not be included in calculations for both federal income tax or Social Security tax. See How To Treat 2019 and Earlier Forms W-4 as if They Were 2020 or later Forms W-4 later for more information.

Smith are both 40 years old and they have two kids in elementary school. This publication supplements Pub. The more you make the more the IRS withholds.

Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax. How to Calculate Federal Income Tax Withholdings. If your other income is high enough you might need to consider making.

There are two federal income tax withholding methods for use in 2021. Federal income taxes also wont be withheld from your paycheck if you claimed exempt on your W-4. This is the simpler method and it tells you the exact amount of money to withhold based on an employees taxable wages number of allowances marital status and payroll period.

For information on federal income tax withholding or to adjust your federal withholding allowances. 2021 2022 Paycheck and W-4 Check Calculator. Account for dependent tax credits.

A withholding is the portion of an employees wages that is not included in his or her paycheck but is instead remitted directly to the federal state or local tax authorities. Over the course of the year you paid more federal income tax than you owed. Federal income tax is based on the employees filing status number of allowancesexemptions earnings and the IRS withholding tax tables.

Figure the tentative tax to withhold. Most people never grow accustomed to the big chunk of federal income tax withheld in each paycheck. In some cases you may want to have additional tax withheld every paycheck so that you dont have tax to pay when you file your return.

Wage bracket method and percentage method. Washington income tax rate. HR Block has been approved by the California Tax.

Heres another example. However there are certain steps you may be able to take to reduce the taxes coming out of your paychecks. The employee can earn a.

All these factors determine the employees federal income tax withholding amount. This is true for any self-employed person earning more than 400 per year and who reports on and files IRS Form. You must meet certain requirements to be exempt from withholding and have no federal income tax withheld from your paychecks.

Solved Federal Taxes Not Deducted Correctly

57 Of U S Households Paid No Federal Income Tax In 2021 Study

Is A State With No Income Tax Like Washington Better Or Worse The Seattle Times

Paycheck Taxes Federal State Local Withholding H R Block

Countries Without Income Tax From Best To Worst

Decoding Your Paystub In 2022 Entertainment Partners

Why Do Some People Pay No Federal Income Tax

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Federal Income Tax

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

Federal Tax Deduction Is Not Coming Out Of Check

Why Would An Employee Not Be Getting Federal Witholding They Are Married Filing Jointly

Solved Federal Taxes Not Deducted Correctly

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Should You Move To A State With No Income Tax Forbes Advisor

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Fast Guide To Dual State Residency High Net Worth Investors